.jpg)

Free resources to manage your student loan repayment

At Financial Plus, we offer the tools, knowledge, and resources to help you handle your student loans as they come back into focus. If you're among the many individuals whose student loans are resuming after a period of dormancy, our free financial coaches are here help you navigate this phase with confidence. We'll provide you with tips on creating a budget that aligns with your financial goals, and help you prepare for adding in your monthly student loan payment.

What you can do now to prepare for loan repayment:

- Review loan terms: Understand the terms and conditions of your student loans, including interest rates, repayment plans, and any changes that may have occurred during the dormant period.

- Gather loan information: Compile all necessary documentation, including loan details, servicer information, and contact numbers, to streamline the reactivation process.

- Check for updates: Confirm if there have been any updates to loan repayment plans, loan forgiveness programs, or deferment options since your loans went dormant.

Free Financial Coaching

We know that each person's financial situation is unique. That's why our team of certified financial coaches is here to offer personalized guidance and create a plan tailored to your needs. The best part? It's completely free to you.

Worksheets and Articles

Ready to tackle student loans? Dive into borrowing, repayment, and budgeting tips with these helpful guides.

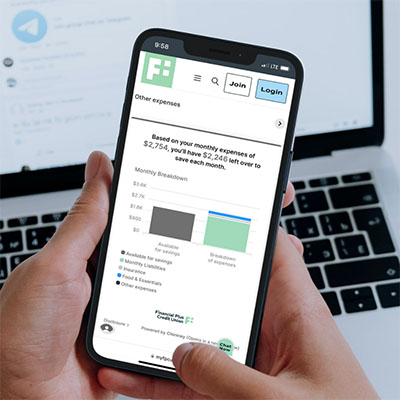

Budget Calculator

Our budget calculator will help you create a financial plan by highlighting areas where you can allocate funds strategically to make student loan payments.

Scholarship Search

We have partnered with Enrich to help you find hand-picked, quality scholarships to help pay for school.

.jpg)

Federal Student Aid

Navigate the world of student loan repayment with confidence, using valuable insights from Federal Student Aid.

Consumer Financial Protection Bureau

Enhance your understanding of student loans with valuable insights from the Consumer Financial Protection Bureau.

Modules

Staying on track with student loans while in school

At this stage in your education, you have the double task of managing your existing student loans while continuing to borrow. With an emphasis on how to minimize your student loan debt in the future, the course first offers a refresher on the federal student aid program, including details on how your existing loans are growing, borrowing limits, and other factors that may affect your borrowing decisions.

Repaying your student loans

This course will explain the tools available to you as a student loan borrower and the many repayment plans in place to suit a variety of financial needs. You will also learn strategies and methods for making the repayment process easier, including a few opportunities when debt might be alleviated.

When do student loan payments resume?

Student loan interest will resume starting on Sept. 1, 2023, and payments will be due starting in October

Are deferments and forbearances always an option?

Deferments and forbearances have specific eligibility requirements and, with the exception of the in-school deferment, have limited lengths of time they can be used over the life of the loan.

What is the SAVE plan?

The Saving on a Valuable Education (SAVE) Plan replaces the existing Revised Pay As You Earn (REPAYE) Plan.

The SAVE Plan, calculates your monthly payment amount based on your income and family size.

What is Student Loan Forgiveness?

The U.S. Department of Education offers several forgiveness and discharge programs for federal student loans. You may qualify to have some or all of your loans forgiven or discharged in certain situations.

Ways To Qualify for Loan Forgiveness

- If you're a Teacher

- If you're a Government Employee

- If you work for a Nonprofit

- If you're a Nurse, Doctor, or Other Medical Professional

- If you have a Disability

- If you repay your loans under an Income-driven Repayment Plan

Learn more about student loan forgiveness.