Get $1,500 off Closing Costs

Congratulations on taking the exciting step towards becoming a first time homebuyer! We understand that purchasing your first home can be both exciting and overwhelming. That's why we created our First-Time Homebuyer Program*—to help relieve some of the stress and make this process as smooth as possible for you.

With the exclusive First-Time Homebuyer Program, you get $1,500 off closing costs when you open a checking account with a debit card, direct deposit, and auto pay.*

Our local mortgage experts have the tools, knowledge, and resources to make your journey to homeownership simple as can be. Click the "More Info" button below to explore the program.

What First-Time Homebuyers Need to Consider:

There is much more that goes into buying a house than just your mortgage. If this is your first time purchasing real estate for yourself or your family, be aware of the various financial factors and how they impact your final purchase price and monthly payment.

Down Payments

The down payment you provide for a home both secures your property and protects it against additional interest charges. Down payments fluctuate widely between buyer goals, loan types, and term lengths. Generally, the minimum down payment is only 3% but, everyone's minimum down payment may vary based on their situation.

Closing Costs + Prepaids

The fees associated with transferring homeownership, as well as completing the sale of a home, are known as closing costs. Although the name suggests they might be an afterthought, you should factor in that closing costs average between 3% to 5% of your total loan. Ensure you have the additional funds to cover closing costs at the time of purchase.

Ready to apply for a mortgage?

Applying is easy. Select "Apply Online" below and "Create Account" to get started.

What to expect during your mortgage application:

If you currently have a Consumer Connect Mortgage account, you will be asked to log in. If you do not have a Consumer Connect Mortgage account, you will need to create one to start your mortgage application.

You may find it helpful to gather the following items before you begin:

- Information about your existing mortgage loan (if applicable)

- Pay stubs or recent tax returns to reference current income

- Bank statements and retirement account balances for assets

Once your application is submitted, you will receive a confirmation email from our team. A Financial Plus mortgage expert will get in touch to review next steps within 1 business day.

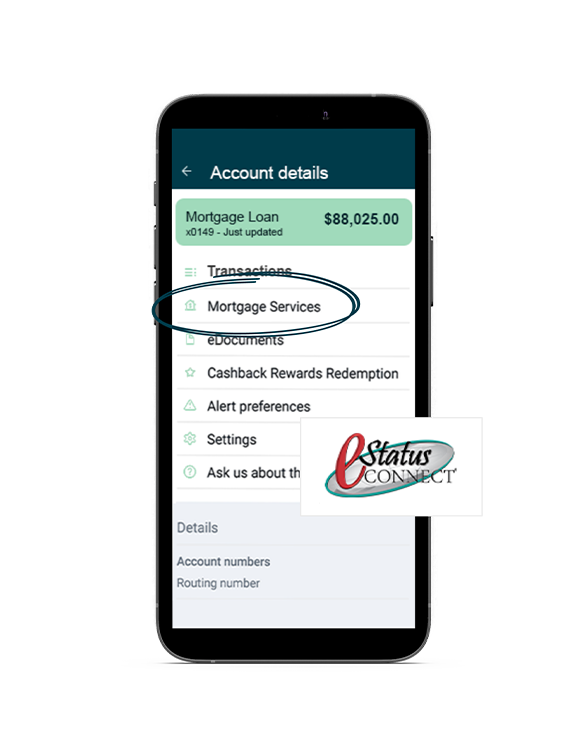

Manage your loan with eStatus Connect

Use eStatus Connect within your digital banking to make payments and view:

- Payment due date

- Payment history

- Current loan balances

- Previous and current year-to-date totals

- Upcoming interest and escrow changes

Conventional Fixed Rate

A fixed-rate mortgage comes with an interest rate that won't change for the life of your home loan. Monthly principal and interest payments on a conventional fixed-rate mortgage remain the same for the life of the loan making it an attractive option for borrowers who plan to stay in their home for several years.

Benefits and considerations:

- No interest rate surprises - the interest rate won't change for the life of your loan, protecting you from the possibility of rising interest rates

- The lowest fixed rate - Conventional mortgages may offer a lower interest rate than other types of fixed-rate loans

- Refinancing options available - Conventional fixed-rate mortgages are available for refinancing your existing mortgage, too - and 15- and 20-year options are especially popular.

Jumbo

A jumbo loan is for someone financing a home in a highly competitive real estate market, exceeding conventional loan limit of $548,250 for a single-family home in Michigan. Jumbo loans come with different underwriting requirements versus a conventional loan and tax implications (see your tax advisor).

Federal Housing Administration (FHA)

Michigan State Housing Development Authority (MSHDA)

MSHDA loans are available to first-time homebuyers state-wide and repeat homebuyers in targeted areas. All homebuyers work directly with a participating lender. Household income limits apply and can vary depending on family size and property location. Down payment assistance is available.

- Sales price limit: $224,500

- Minimum credit score of 640 required or 660 for multiple-section manufactured homes

Rural Development (RD)

Vacant Land

When choosing to build, it's common that the land must be purchased before building the home. Vacant Land loans from Financial Plus provide the financing to do just that.

A Vacant Land loan is a great choice for future home builders who:

- Have a plan, but may not want to jump right into building a home immediately

- Have a building project that may be scheduled out a year or so in advance

Solutions for every aspect of life

Mortgage Loan Officers and NMLS Numbers:

Financial Plus Credit Union - NMLS License #586579

Will Baranyai, MLO - NMLS #1311781

Brooke Taylor-Huey, MLO - NMLS #642942

Rosemary Boan, MLO - NMLS #1531295

Amy Ricupati, MLO - NMLS #674678

Sherrie Dalton, MLO - NMLS #629441

Jim Gioia, MLO - NMLS #589351

Rachelle Kippe, Senior Vice President of Lending - NMLS #423273

Marcia Dinauer, Mortgage Sales Manager – NMLS #855164

*A first-time homebuyer is anyone who has not previously owned a home and is purchasing their first home. To qualify for the program, the following criteria must be met with your Financial Plus member account: checking account, a Financial Plus debit card, established direct deposit with sign-up for automatic payment from your Financial Plus account. Some restrictions may apply. This program cannot be combined with any other offer or promotion.

Rates, terms, and conditions are subject to change and may vary based on creditworthiness, qualifications, and collateral conditions. All loans subject to approval. See Credit Union for full details.