Set sail with a Financial Plus Boat Loan

Living in the Great Lakes State means that the call of the water is in our DNA. Our team is here to provide you with guidance, advice, and a helping hand throughout your boat loan application process. We're committed to ensuring you're empowered to make the best decisions for your boating journey. Apply for a boat loan from Financial Plus today!

Refinance |

Purchase |

Get 1% off your current rate

|

Get 1.50% off your next loan rate

|

How to apply for an FPCU boat loan:

- Apply online by clicking the button below

- Stop into any of our locations and chat with a representative

Make your dreams a reality with a boat loan from Financial Plus

- Expertise in your corner: When you choose FPCU for your boat loan, you're choosing a team of financial experts who are here every step of the way. Our experience in helping members achieve their financial goals extends to making your boating dreams come true.

- Competitive rates, lower costs: We're proud to offer highly competitive interest rates on our boat loans, allowing you to save on interest over the life of your loan. Plus, our commitment to low fees ensures that you enjoy more value from your loan experience.

- Personalized solutions: At FPCU, we know that your boating journey is unique. That's why we tailor our boat loans to fit your specific needs, ensuring that your loan terms align with your financial situation and goals.

- Local connection: FPCU is deeply rooted in the communities we serve. When you choose us for your boat loan, you're supporting a local institution that reinvests in the well-being of the community and understands the unique joys of boating in our region.

- Financial education: We're not just about loans; we're about your financial success. FPCU provides FREE financial coaches, educational resources, tools, and advice to help you navigate your loan and manage your finances effectively.

- Your partner for life: Beyond the boat loan, FPCU remains your lifelong financial partner. As you sail through life's financial waters, we'll be there to provide support, guidance, and the tools you need to achieve your dreams.

Get pre-approved before you shop for a new boat

- Know your budget: Pre-approval helps you understand your purchasing power. You'll know exactly how much you can afford, allowing you to shop for a boat that fits your budget without any surprises.

- Shop with confidence: With a pre-approved boat loan from FPCU, you'll be a step ahead when you visit dealerships or private sellers. You can negotiate confidently, knowing that your financing is already secured.

- Faster transactions: Pre-approval speeds up the purchasing process. Once you find your dream boat, you can finalize the deal quickly without waiting for financing to be arranged.

- Tailored terms: FPCU's pre-approval process allows us to tailor loan terms to your unique financial situation. You'll enjoy a loan that fits your needs, whether it's a specific repayment period or competitive interest rates.

- No obligations: Pre-approval doesn't commit you to taking the loan. You have the flexibility to explore your options and decide if the pre-approved loan meets your needs before making a commitment.

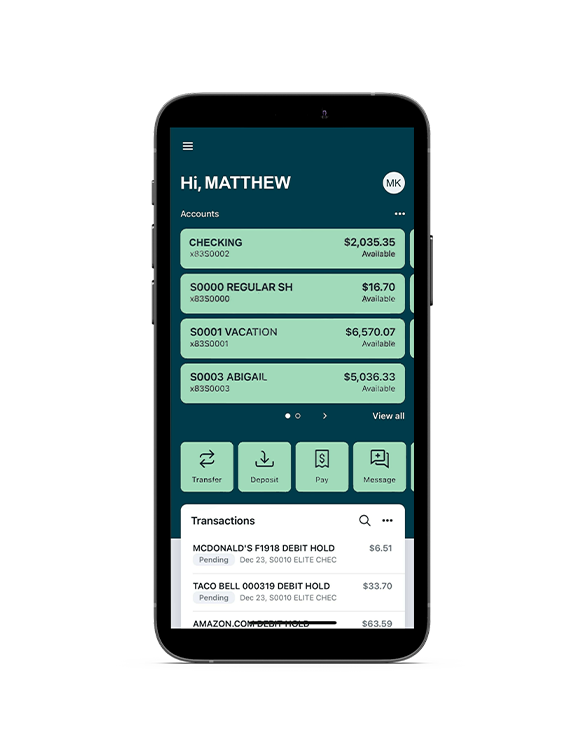

Easily manage your loan

Sign up for digital banking in minutes online or at any branch location and download the mobile app to take us wherever you go.

Solutions for every aspect of life

*APR = Annual Percentage Rate. Subject to approval based on creditworthiness. Rates may vary based on each individual’s credit history and underwriting factors. The Credit Union will reduce the rate of your existing non-Financial Plus loan by 1% (subject to a minimum rate of 4.79% APR for auto, 5.04% APR for boat, 5.79% APR for RV, 6.24% APR for motorcycle, and 7.24% APR for powersport loans). Proof of the current rate and terms of the loan to be refinanced is required. Promotion only applicable to secured auto, boat, RV, motorcycle, and powersport loans. Promotion does not apply to existing loans with the Credit Union, purchases or lease buyouts. Rates and terms are subject to change without notice. Cannot be combined with Loyalty Rate Discounts. The Credit Union reserves the right to modify or discontinue this offer at any time without notice. Offer expires 6/30/25. Some restrictions apply. See Credit Union for details.

**APR=Annual Percentage Rate. Refinances of eligible Financial Plus Credit Union loan(s) qualify for member discount at today’s rates. The Loyalty Discounts exclude lines of credit, Greenlight Loan, mortgage, home equity, and commercial loans. Direct Deposit of the payroll is required. If Direct Deposit and Auto Pay requirements are not maintained, you may be subject to a Direct Deposit/Auto Pay Cancellation Fee in the amount of $125.00. Offer expires 6/30/25. See Credit Union for complete details.